In Late February RedZone Software CEO Clark Woodward and COO Michael Flannery attended the Cat Risk Management Conference in Orlando, FL. The conference is hosted every year by the Reinsurance Association of America (RAA). The event brings leading global experts together to meet and discuss catastrophe risk management. Representatives from all across the industry were present, including: reinsurers, modeling companies, researchers, regulators, and academics. As the conference subtitle for 2019 indicates, attendees are invited to look toward “The Future of Catastrophe Management – 2020 and Beyond”! This is RedZone’s 2nd year in attendance featuring the RZRisk and RZExposure solutions we offer.

Solutions for Underwriting Wildfire Risk

While at the conference, RedZone Software, along with RedZone Analytics, hosted a booth and shared a presentation showcasing Strategies for Optimizing Portfolios for Wildfire Risk. Dr. Ellie Graeden and Clark Woodward, the Founders of RedZone Analytics, discussed the process of “portfolio optimization” – which is described as distributing assets to support an insurance business case based on comparative analysis between potential portfolios. Typically, insurance strategies maximize factors such as expected return and minimize cost like financial risk. Toward this end, RedZone has built Correlated Risk Zones which allow for the aggregation of a portfolio or development of a strategy for a growing portfolio. Insurance companies want boundaries that make tactical sense to develop their strategies, but also allow them to apply it down to the underwriting level. RedZone Analytics provides a way to do both.

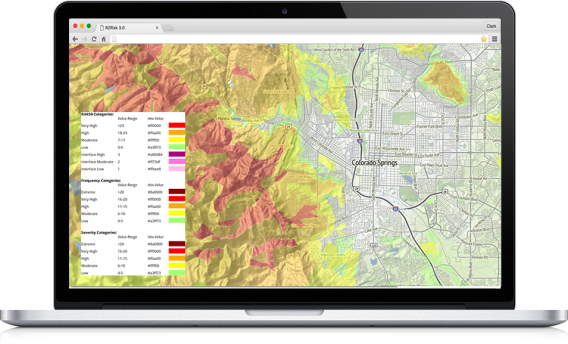

An example of RZRisk Dashboard.

RZRisk, along with RZExposure, helps answer the question “How do you think about wildfire risk across the entire portfolio, not just on a policy by policy basis?” Companies want to distribute assets in a risk-based way, aligning location risk data with strategic priorities. In order to simplify the process, RedZone’s integrated dashboard supports analysis at both property and portfolio scales. The last few years of major losses has changed the way the insurance industry has to think about being profitable. RedZone’s product offerings are helping many companies manage capacity, develop reinsurance strategies, and set pricing and eligibility.

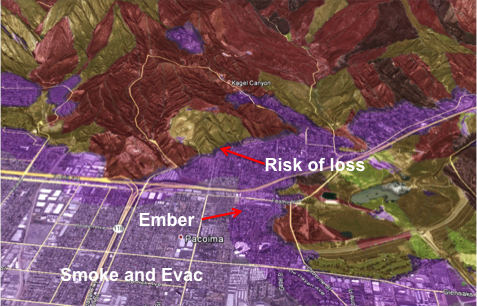

Differentiating types of risk at a local level.

Interested in RZRisk or RZExposure? Read more here:

Wildfire Underwriting Solutions – RZRisk: https://www.redzone.co/rzrisk/

Wildfire Exposure Platform – RZExposure: https://www.redzone.co/rzexposure/