The increase in natural disasters presents a significant challenge globally. Their escalating frequency and intensity demand a concerted response, especially from those living in vulnerable areas and the insurance industry, which plays a vital role in financial recovery post-disaster. Understanding these trends is key to developing effective risk management and mitigation strategies.

2023 Highlights: A Record-Breaking Year in Disasters

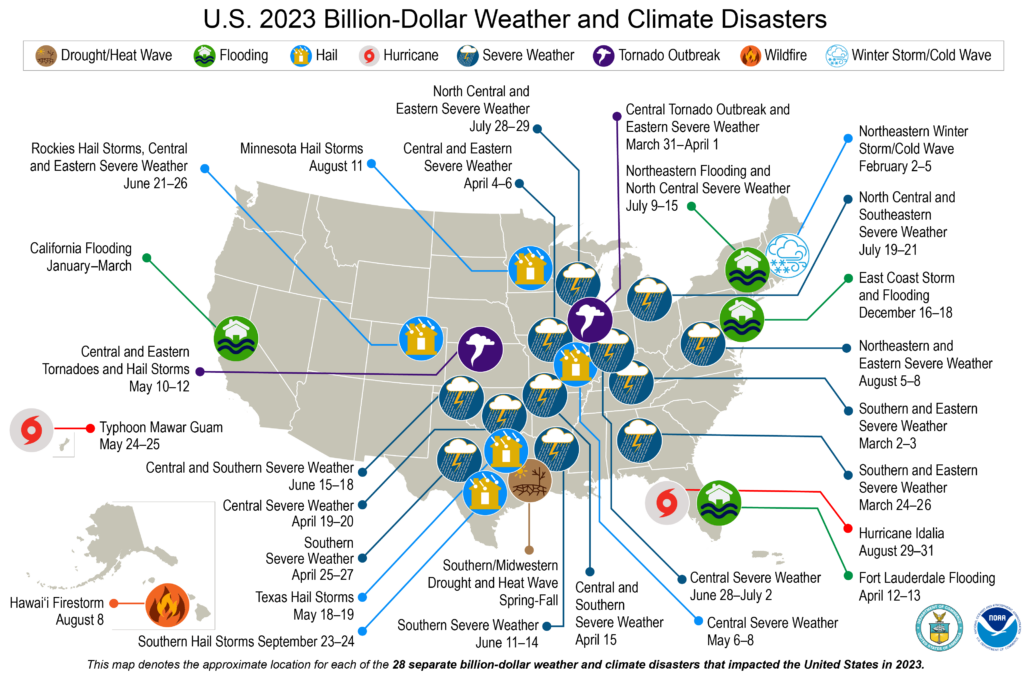

Reflecting on recent trends, the year 2023 set a new record in the U.S. for the number of major weather and climate disasters with 28 events each costing over $1 billion. This unprecedented tally makes 2023 the year with the highest number of billion-dollar disasters in a single year. Specifically, the year witnessed a wide range of disasters, including:

- A severe winter storm and cold wave affected the northeast early in February.

- A devastating wildfire that obliterated Lahaina in Maui, Hawaii.

- A significant drought and heatwave primarily impacted the central and southern regions.

- Four major flooding incidents in California, Florida, and parts of the eastern and northeastern U.S.

- Two large-scale tornado outbreaks across the central and eastern states.

- Two destructive tropical cyclones, namely Idalia in Florida and Typhoon Mawar in Guam.

- Seventeen severe weather and hail events in various parts of the country.

Tragically, these disasters also resulted in a substantial human toll, with at least 492 fatalities, ranking as the 8th highest in disaster-related deaths in the contiguous U.S. since 1980. This alarming statistic underscores the growing impact and frequency of such catastrophic events.

Notably, the most expensive were the Southern/Midwestern Drought and Heat Wave, and severe weather in the South and East, costing $14.5 billion and $6.0 billion respectively. This year’s events contribute to the U.S.’s long-term record of 376 significant disasters since 1980, accumulating costs over $2.660 trillion. 2023’s events are part of a larger trend of increasing frequency and cost of disasters, influenced by factors like population growth, development in vulnerable areas, and climate change. This trend emphasizes the need for strategic building and infrastructure development to mitigate future risks.

The Role of Insurance in Disaster Management

Insurance is an indispensable tool in disaster recovery. It provides financial stability to individuals and businesses, aiding in rebuilding and recovery efforts. However, as the nature of natural disasters evolves, so too must the insurance industry’s approach to risk assessment, policy pricing, and claims management.

Insurers are currently at a crossroads, needing to adapt their models and strategies to a rapidly changing risk landscape. This involves not just tweaking existing policies but a fundamental rethinking of risk assessment models to incorporate the increasing unpredictability and severity of natural disasters.

Changes in the insurance industry have a direct and profound impact on policyholders. In high-risk areas, for instance, insurance is becoming more expensive. This situation necessitates a deeper understanding among policyholders of their insurance needs and potential vulnerabilities.

Technological Advancements in Risk Assessment

Technology is playing a crucial role in reshaping how the insurance industry manages risks. Advanced modeling tools and AI are enabling insurers to analyze vast amounts of data, leading to more precise risk assessments and more dynamic pricing models. These technologies are critical in providing a more nuanced understanding of risk, allowing for better preparedness and response strategies.

For over a decade, RedZone has been at the forefront of this technological innovation, particularly in the context of wildfires. The RZRisk platform goes beyond mere risk scoring; it allows for a detailed, location-specific assessment of wildfire risk. This nuanced approach to risk assessment is not just about identifying risks but also finding viable opportunities in seemingly high-risk areas.

This integration of expert-driven operational experience with robust quantitative analysis allows for effective management of portfolio concentrations. The platform’s ability to correlate risk zones using the latest probabilistic wildfire simulations enables insurers to group vast regions at risk of being lost in a single event, thereby enhancing strategic planning.

The Importance of Public-Private Collaboration

Effective disaster management requires collaboration between various sectors. The insurance industry, governments, and communities must work together to develop comprehensive strategies for disaster response and recovery. This collaboration is essential for pooling resources, sharing knowledge, and ensuring a coordinated effort in the face of disasters.

As we confront an era where natural disasters are becoming more frequent and severe, the role of the insurance industry in fostering resilience is more important than ever. Adapting to this evolving landscape requires innovative approaches, robust collaboration, and a strong commitment to sustainability. For policyholders, staying informed and prepared is key to navigating these changes and ensuring adequate protection.