Have you ever wondered how home insurance companies deal with writing new policies in an ongoing disaster zone? Well the truthful answer is they don’t. For instance, when a large wildland fire is threatening homes or has the potential to, insurance carriers place a moratorium on the surrounding landscape. A moratorium is a temporary, but indefinite hold on writing any new home insurance policies within the blanket area that is declared. The purpose of this practice is to stop new customers who aren’t covered for fire, or other disaster related damages, from buying a policy right before the home is damaged. The problem is the geographic regions that are typically chosen for a moratorium are too large. The regions that are chosen usually include areas that are not threatened by the disaster in any way shape or form. This leaves an undesirable gap in business for both the insurers and possible policy holders. Here at RedZone we like to focus on utilizing technology coupled with expertise to solve complicated problems such as this one.

Wildfire

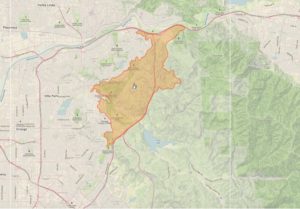

With advances in current wildfire modeling, insurance companies can have a more precise understanding of what is taking place on the ground currently, as well as what is likely to take place in the upcoming hours of the fire. Wildfire modeling accounts for the essential driving factors behind a wildfire so it can accurately depict where the fire is heading. You can read more about the aspects taken into account in RedZone’s Wildfire model here. By using a wildfire model, insurance companies can reduce the size of the geographic areas that are placed under a moratorium. Then the carriers will have an understanding of where the fire will be moving. This benefits both parties involved in many ways. If a home is not covered for wildfire, and a fire breaks out near the home it may spark an interest for the homeowner to obtain coverage on their home for fire. If the area that the home is located in is under a moratorium, the homeowner will not be able to purchase a policy for that type of coverage.

Canyon 2 Wildfire Model – first 24 hours without suppression

Canyon 2 Fire Perimeter – shows the fire’s extent in the first 48 hours with suppression

Hurricane

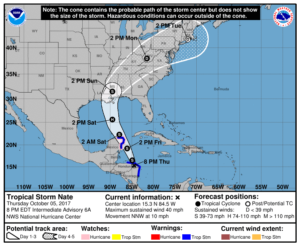

In the case of hurricanes, insurance carriers are even more precautious about writing new business when a storm of hurricane magnitude is approaching. The process of putting a moratorium in place for a storm begins when the National Weather Service declares a low pressure system to be of a tropical storm magnitude. You can learn more about hurricane formation and power at RedZone’s Blog on Hurricanes Harvey and Irma. Insurance companies immediately put a moratorium into effect for the projected zones that will be impacted by the incoming storm. These areas range from zip codes to counties and even expanding to encompass entire states that could possibly be impacted by the storm. A large portion of homes that are located in a moratorium of that size will likely not be affected by flooding or wind damage from the storm.

One of the ways that GIS (Geographic Information Systems) can help with this problem is with a Digital Elevation Model (DEM) Dataset. When loaded into a GIS this data will depict what the terrain on the ground will look like. These elevation layers coupled with flood plain data would give an accurate depiction of the level of threat to a structure. What has to be taken into account is that each storm is different. The flood data chosen must accurately match the expected rainfall from the storm in the general location. One solution is to utilize the most severe flood data available, so that the estimations are on the safer side. Another factor that needs to be considered is the damage that occurs from wind during one of these events. GIS is capable of running buffers based on the projected storm path. A buffer coinciding with the relative wind speeds that are capable of damaging homes would be a safe way of creating more accurate moratorium zones during a hurricane.

NOAA Potential Track Map issued Thursday Oct 10th, 8pm eastern

Source(s):

http://wiseinsurancegroup.com/insurance-moratoriums-binding-prohibitions/

https://www.insurancejournal.com/news/west/2017/12/18/474612.htm

https://www.jebrown.net/content/169/brush-fire-moratorium

http://velocityrisk.com/commercial-insurance/moratorium-policy