In October 2022, California Insurance Commissioner Ricardo Lara introduced the nation’s first wildfire safety regulation to credit homeowners for wildfire preparedness. The aim was to help subdue the rising cost of homeowners insurance in the state. In addition, the insurance market in California has changed drastically over the past few years. Mostly, it is due to the sustained risk and growing costliness of damage from wildfires. Correspondingly, many vulnerable homeowners across the state have had their insurance drop them or seen their rates grow astronomically. The California Department of Insurance (CDI) worked closely with state agencies to develop a ‘Safer from Wildfires’ framework to address the issue.

The framework provides a list of actions and mandates insurance offerings. Insurers will give coinciding credit to consumers who adhere to the suggestions outlined in it. As of Dec 27th, the regulation is now state law and enshrined in the California Code of Regulations. According to the regulation, “insurance companies are required to make new rate filings including wildfire safety discounts and comply with new transparency measures starting in April 2023.”

Safer From Wildfires Credit

According to the One Pager provided by the DOI, the Framework draws expert opinions using the latest research on wildfires. Specifically, it provides a list of achievable and effective actions to help make existing properties safer from wildfires. The framework first aims to protect Californians by reducing wildfire risk in their communities. Ultimately, it hopes to make insurance not only more available but also to credit Californians for doing their part. It’s a win-win. Homeowners have a way to reduce their wildfire risk AND their rising insurance costs.

“Insurance companies are required to make new rate filings including wildfire safety discounts and comply with new transparency measures starting in April 2023.”

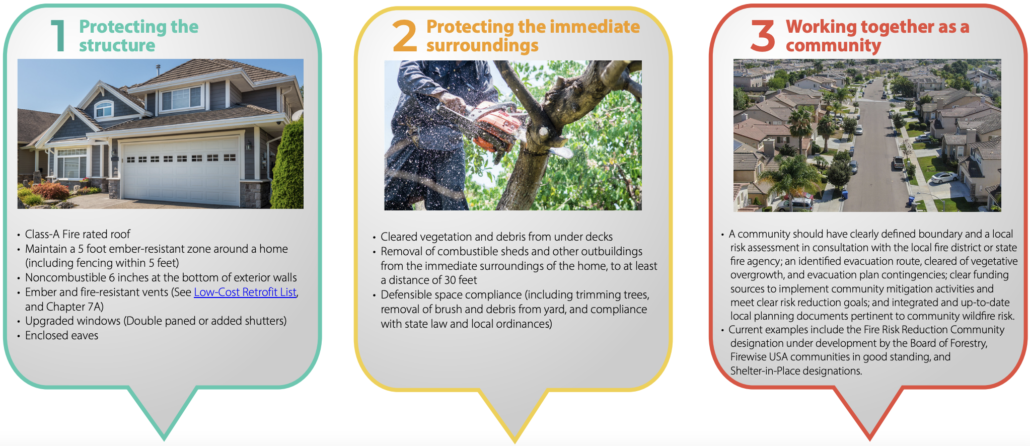

The ‘Safer from Wildfires’ Framework has three layers of protection — for the structure, the immediate surroundings, and the

community — to prevent wildfires from catching and spreading to other homes and businesses in the neighborhood.

How About RedZone’s Framework

RedZone has been closely tracking the CDI regulations. As a result, our team has been working hard to implement an easy adaptation of for our customers through our proven Wildfire Underwriting Solution, RZRisk. By the April Deadline, RedZone is excited to evolve its trusted service to offer adherence to the new regulation. But, addressing the problem from the Underwriter’s perspective, is only half the issue. Therefore, RedZone has also taken the opportunity to partner with several boots-on-the-ground programs to guide homeowners in their mitigation efforts. And through these programs, highlight the specific actions that would warrant these wildfire safety discounts. As a long-time proponent of property-level wildfire mitigation, we are excited and proud to both help the insurance companies and moreover, the insured themselves, tackle this growing issue.

8 Comments