Looking Back at 2017-2018 Fire Seasons in California

In 2017 the state of California experienced a fire season that seemed to surpass any other in recent memory. This disastrous fire season was then exceeded in terms of lives lost, and destruction to property by the 2018 fire season. In October 2017, the Tubbs Fire took its place as the most destructive wildfire in California’s history by destroying 5,636 structures, and killing a total of 22 people. In the wake of this tragic event that befell the Northern Bay area communities, the people of California were wishfully thinking that the reappearance of these extreme fires would subside for an extended period of time. These optimistic thoughts were quickly given a reality check when the Camp Fire destroyed the community of Paradise, CA in the matter of hours. Fire officials continue to diligently complete the search for missing citizens, and damage inspections of the surrounding areas, the numbers below are current up to when this was published. As of right now the total number of destroyed structures is 18,804, which over triple the previous most destructive fires record. The death count for this incident is staggering as well with the current number being 85 human lives lost during this incident. The Thomas Fire in December was the second record setting fire of 2017, taking the position of most acres burned. This record was overtaken this year by the Ranch Fire, which burned 410,203 acres near Clearlake, CA. With these disturbing fires seemingly getting worse every year, what do the upcoming changes look like for the average homeowner in California?

Insurance

For home insurance carriers, the State of California is being assessed as a risk versus gain analysis, on a geographic, case-by-case basis in relation wildfires. These companies are becoming more and more hesitant to expand into the more rural reaches of California. In some areas, certain home insurance carriers have resigned to no longer writing new business due to the extreme wildfire risk that has been becoming ever so prevalent in recent years. These same companies will be quietly removing their presence from these aforementioned areas by no longer renewing policies when the term of their legal obligation is up, at which point a non-renewal notice is issued. In efforts to account for the increase in economic losses that the insurance carries have, and will be seeing due to wildfire, there is no doubt that premium rates will be going up. These increases will be seen across the entirety of the state, but as you move into the more fire prone areas, otherwise known as the wildland urban interface, the rate at which the increase will occur will be more dramatic.

To protect the residents of California, the state legislature has passed a bill clarifying that catastrophic losses to insurance companies cannot be passed onto ratepayers in one large lump sum. What will eventually happen is, there will be a steady increase in yearly premiums over a number of years to assist with the companies trying to recoup from these devastating events. There is a similar process when a utility company is found to be the root cause of a wildfire.

Utility Companies

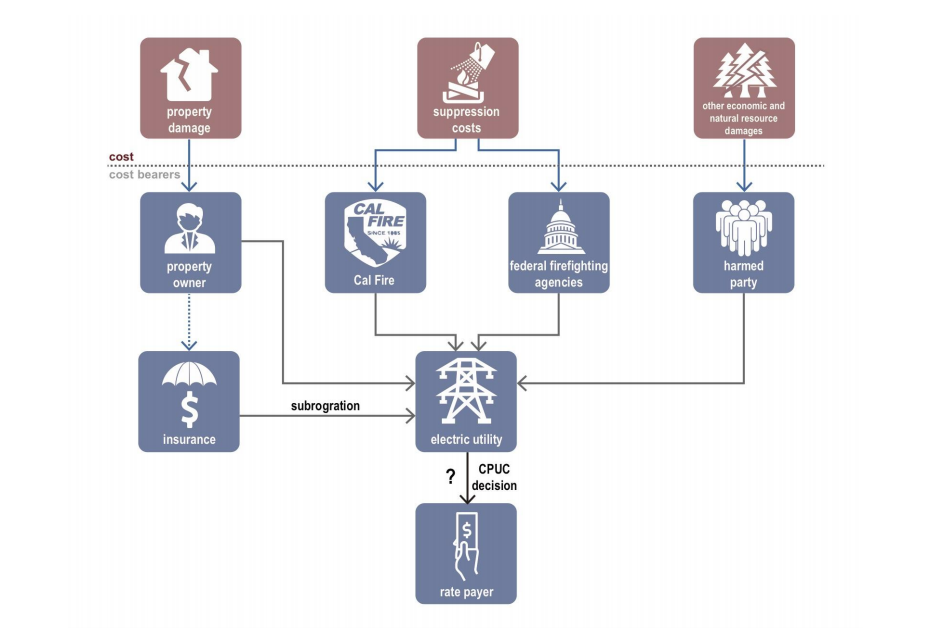

When utility company’s equipment has been found to be the cause of a fire, these entities can be liable for shouldering the costs of fire suppression, damages to structures, and damages to other economic and natural resources as well. The amount of money that these factors add up too, can be quite staggering.

This diagram shown in the paper “Wildfire Costs in California: The Roll of Electric Utilities” written by Wharton University of Pennsylvania, gives a visualization of the legal process post wildfire.

In the case of investor owned utility companies, such as Pacific Gas and Electric, how these costs are paid for is determined by the CUPC (California Public Utilities Commission). Since rates are fixed for publicly owned utility companies, the recoupment of the costs in relation to a fire have to be evaluated by the CUPC before the burden can be placed onto ratepayers. The CUPC evaluates the Utilities request to have the ratepayers absorb this cost by determining if the company has abided by acting “reasonably and prudently” in relation to the failure of their equipment. If the utility company is found to be negligent in anyway, this request to pass the financial burden onto the ratepayers would be declined.

Sources:

https://www.insurancejournal.com/news/west/2018/08/02/496904.htm

https://www.cnbc.com/2018/11/16/fire-plagued-ca-wont-let-insurers-cram-through-big-rate-hikes.html

https://www.thebalance.com/wildfires-economic-impact-4160764

One Comment