Wildfire Risk Scoring Solutions

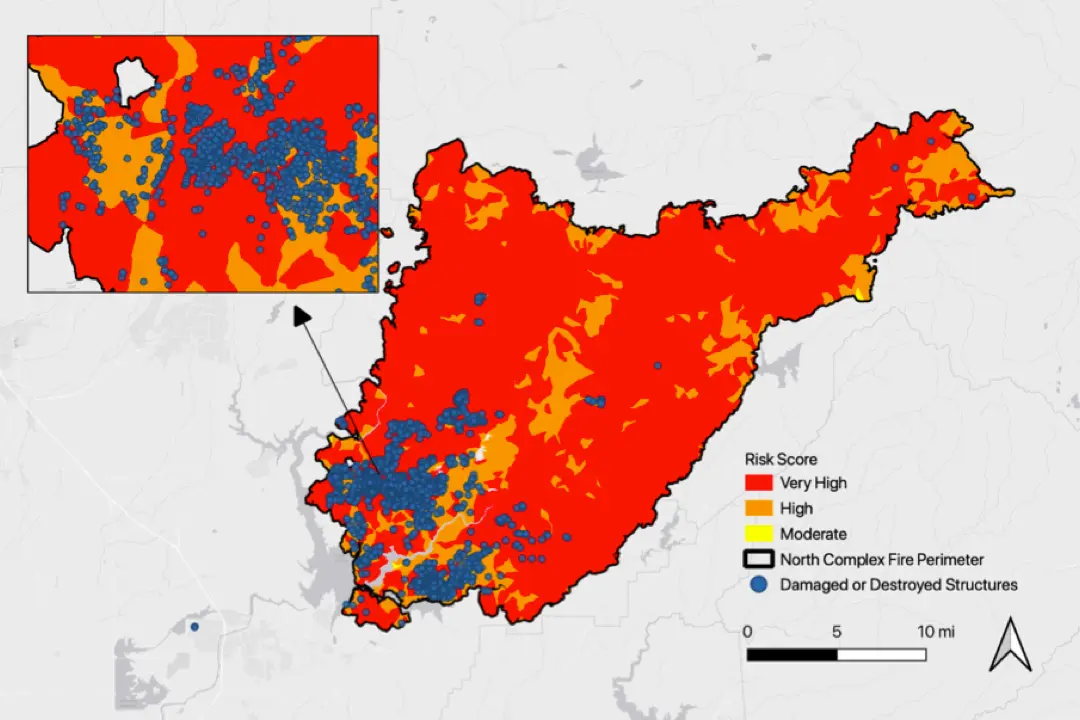

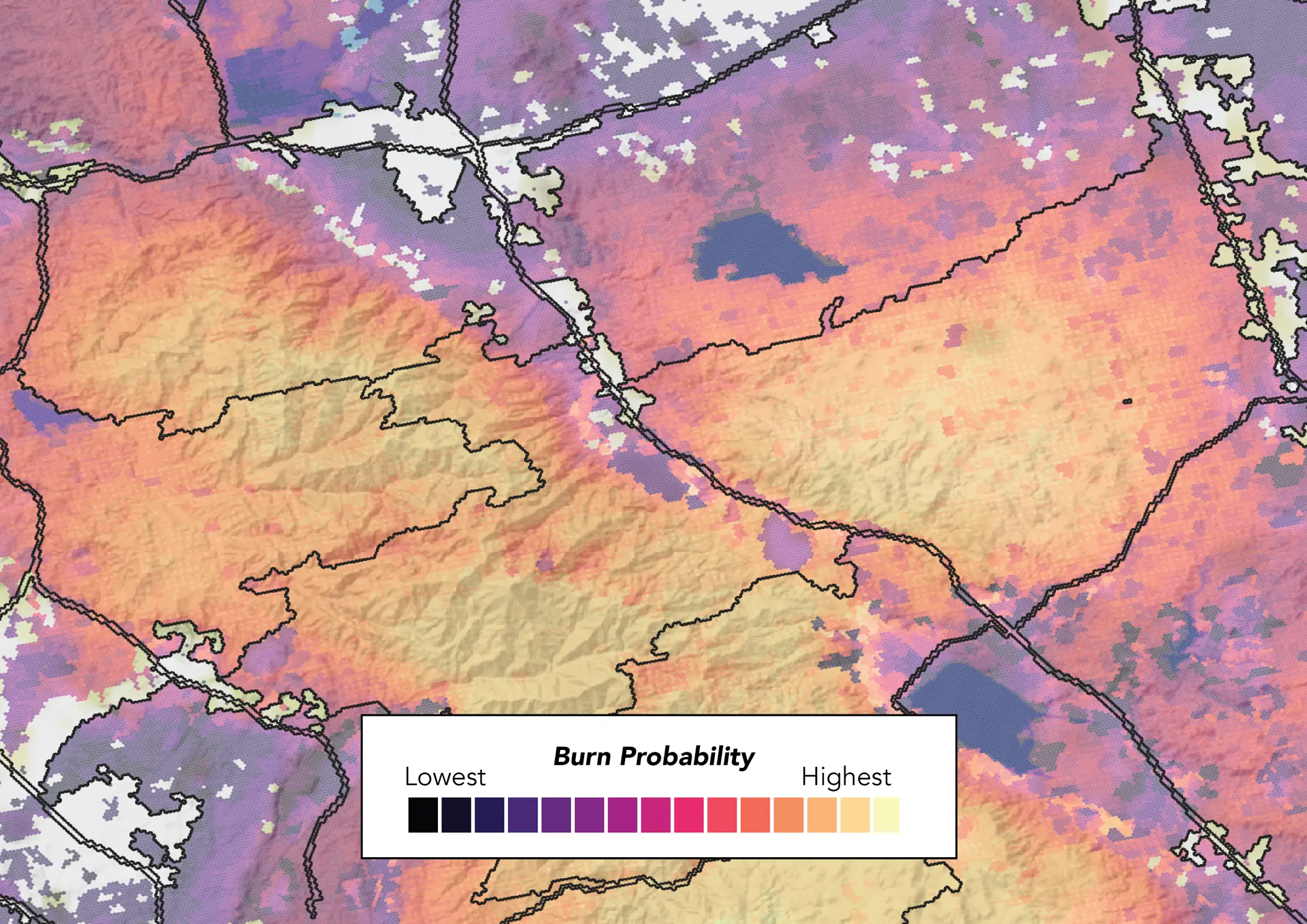

RedZone’s cutting-edge technology and advanced algorithms enable forecasting wildfire risk, empowering insurance underwriters to make informed decisions and strategize based on data, not opinions. With our state-of-the-art wildfire risk assessment tool, we quantify wildfire risks based on frequency and severity, calculating multiple component wildfire risk scores and an overall wildfire risk score, enabling insurance companies to minimize their exposure to wildfire based on their desired underwriting criteria. read more minimize

Wildfire Risk Analysis & Insights

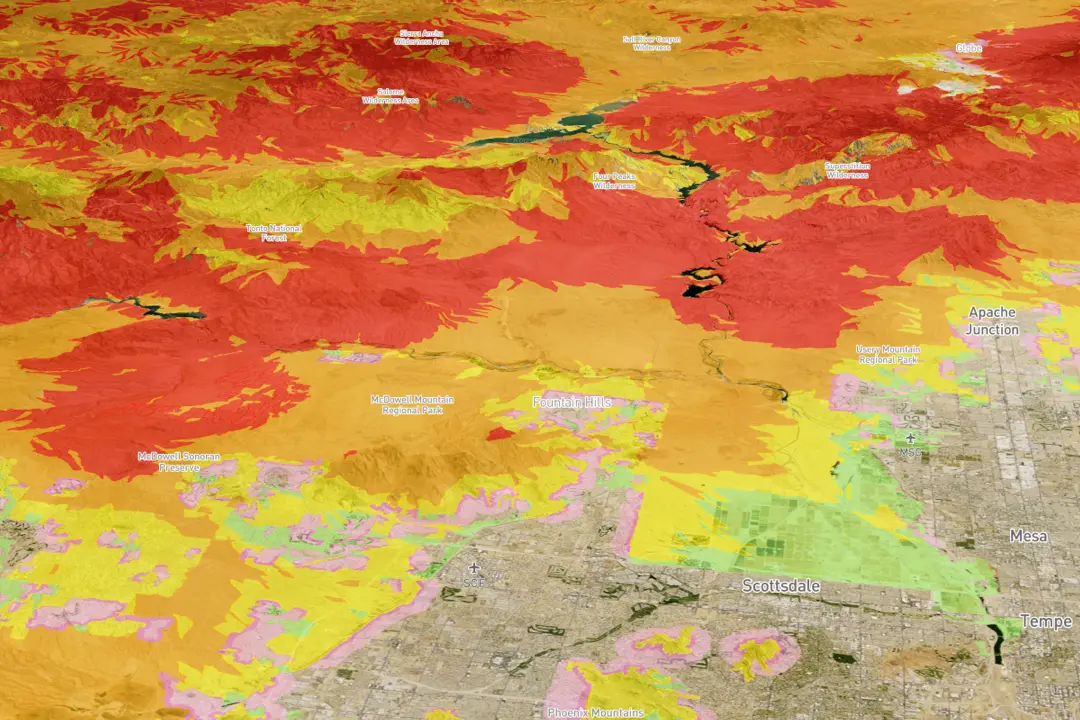

With RedZone’s comprehensive wildfire risk analysis and insightful solutions, as an underwriter, you can confidently determine wildfire danger ratings and stay one step ahead of wildfire losses. Our advanced forecasting techniques and cutting-edge wildfire models provide accurate predictions of wildfire likelihood. read more

Manage Wildfire Risk

RedZone’s powerful platform equips insurance underwriters with the tools they need to effectively manage wildfire risk. Our algorithmic risk assessment, wildfire modeling solutions and risk minimization capabilities provide a robust framework for assessing wildfire risk and developing proactive strategies. With our advanced technology, you can detect wildfires in near real-time, enabling you to respond quickly and efficiently. read more

Property Risk Assessment

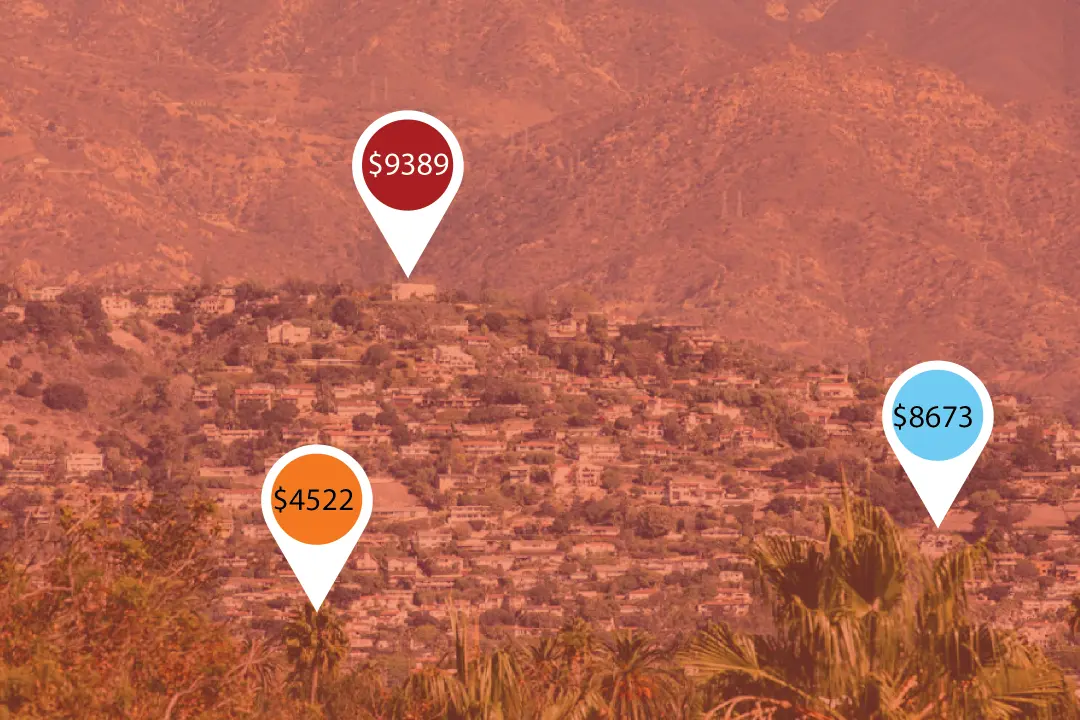

RedZone introduces a game-changing property level risk assessment tool specifically designed for insurance underwriters. In the face of increasing risk and devastating wildfires, accurately assessing the vulnerability of homes and properties by assigning them a wildfire risk score is crucial. Our innovative Wildfire Risk Scoring System equips insurance underwriters with the necessary insights to evaluate wildfire exposure effectively. read more

Trusted by

FAQ

What is Wildfire? A wildfire, also known as a forest fire or bushfire, is an uncontrolled fire that spreads rapidly across vegetation, such as forests, grasslands, or shrublands. It is characterized by its ability to quickly consume large areas of land, fueled by the availability of dry vegetation and favorable weather conditions. Wildfires can be triggered by natural causes, such as lightning strikes, or by human activities, including arson or accidental ignition. Once ignited, wildfires can spread rapidly, driven by the combination of heat, oxygen, and fuel. These fires can be highly destructive, causing damage to ecosystems, wildlife habitats, and human structures. They also pose risks to human safety, air quality, and can have significant economic and environmental impacts. What is Wildfire?

Why do wildfires occur? Human activities account for almost 90% of wildfires across the country. The primary culprits behind these human-ignited fires include unattended campfires, burning debris, hot ashes and barbecue coals, as well as sparks emitted by vehicles and equipment. However, it’s not just human behavior that contributes to the prevalence of wildfires. Environmental factors, like rising temperatures, altered precipitation patterns, decreased humidity, and the rapid Why do wildfires occur?

proliferation of vegetation, also play significant roles in fueling and spreading these fires.

Why are wildfire risks increasing? Overall, the combination of climate change, human activities, and outdated fire management practices has resulted in an increased frequency and severity of wildfires, making wildfire risks a growing concern. Why are wildfire risks increasing?

What can be done to stop wildfires? While it is impossible to completely eliminate the risk of wildfires, there are various measures that homeowners and communities can undertake to reduce the risk of loss associated with wildfires, such as ensuring construction materials are fire tested and that defensible space is maintained around the structure. What can be done to stop wildfires?

Can wildfire risk be completely eliminated? Stopping wildfires entirely is not feasible, as fire is a natural and essential part of many ecosystems. However, several measures can be taken to mitigate the risks and minimize the impacts of wildfires. Here are some key strategies: Prevention: Emphasize public education and awareness campaigns to promote responsible behavior in fire-prone areas. This includes proper campfire management, safe disposal of cigarette butts, and adherence to fire restrictions and regulations. Land Management: Implement proactive land management practices such as controlled burns, also known as prescribed fires, to reduce accumulated fuel loads. This helps maintain healthier ecosystems and minimizes the risk of uncontrolled wildfires. Infrastructure Planning: Encourage land-use planning that considers wildfire risk, such as maintaining defensible spaces around homes and structures, using fire-resistant building materials, and creating fire breaks or fuel breaks to slow down the spread of fires. Early Detection and Rapid Response: Invest in early detection technologies, such as remote sensing and aerial surveillance, to detect wildfires in their early stages. This allows for prompt response and containment efforts to prevent fire spread. Firefighting Resources: Ensure adequate resources, including trained firefighters, equipment, and aircraft, are available to respond swiftly to wildfires. Collaboration between local, state, and federal agencies is crucial for effective firefighting operations. Community Preparedness: Encourage communities to develop and implement emergency response plans, conduct evacuation drills, and establish communication systems to alert residents in the event of a wildfire. This fosters a sense of preparedness and resilience among communities at risk. Climate Change Mitigation: Address the root causes of increasing wildfire risks by implementing measures to mitigate climate change. This includes reducing greenhouse gas emissions, transitioning to renewable energy sources, and supporting sustainable land management practices. It’s important to note that managing wildfires involves a combination of proactive prevention, preparedness, and effective response strategies. By implementing these measures, it is possible to reduce the frequency and severity of wildfires and minimize their impact on ecosystems and communities. Can wildfire risk be completely eliminated?

How can insurance underwriters benefit from a wildfire risk assessment and scoring system (like the RZRisk product) provided by RedZone)? Wildfire risk assessment and risk meter / scoring systems provide underwriters with comprehensive and data-driven insights into the wildfire risks associated with specific properties or geographic areas. This enables them to make more accurate risk evaluations and informed underwriting decisions. Wildfire risk assessment systems enable underwriters to identify properties with high wildfire exposure risk. By understanding the specific factors contributing to this risk, underwriters can work with policyholders to implement risk mitigation strategies, such as property modifications or fire prevention measures. By demonstrating their ability to accurately evaluate and manage wildfire risks, they can also attract policyholders seeking comprehensive coverage tailored to their specific wildfire risk profiles. This proactive approach to risk management can help reduce the likelihood and severity of future wildfire-related losses. By utilizing wildfire risk scoring systems, underwriters can assess the overall wildfire risk within their insurance portfolios. This information allows them to effectively balance their exposure and make portfolio adjustments to ensure they are maintaining a healthy risk profile. How can insurance underwriters benefit from a wildfire risk assessment and scoring system (like the RZRisk product) provided by RedZone)?

Contact Us